The CARES Act Paycheck Protection Program: What You Need to Know

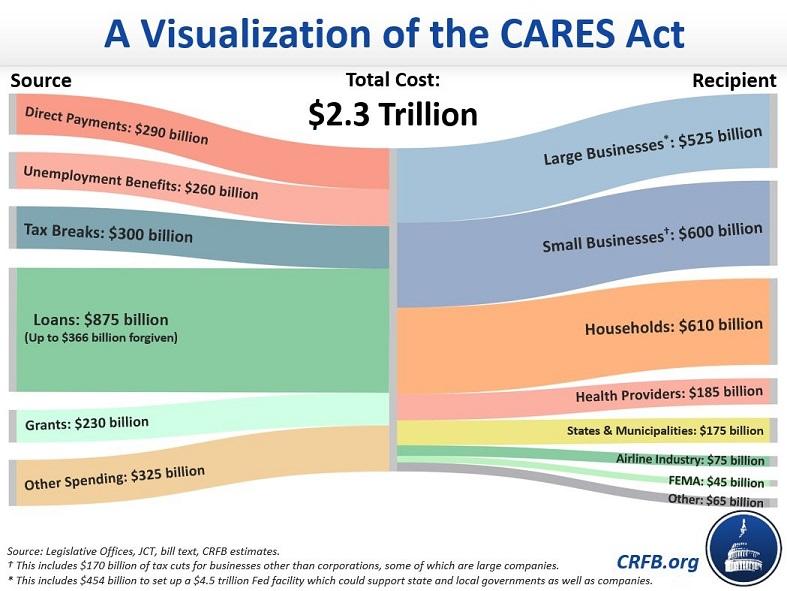

On Friday, March 27, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) became US law. The largest stimulus bill in American history, the CARES act put into motion a momentous effort to provide financial relief for millions of Americans who have been economically impacted by the coronavirus pandemic—in particular, the 3.3 million Americans who’ve filed for unemployment since March 14, and the small businesses who employ so many of them.

Though the CARES Act is packed with provisions for small businesses (including emergency government grants and existing loan payment coverage), the $350 billion Paycheck Protection Program (PPP) might be the most promising portion of the legislation. With its low interest rate and forgiveness potential, the Paycheck Protection Program aims to sustain small businesses through this pandemic without burdening them with significant debt to pay off when the crisis has passed—and, in the process, its goal is to keep people in their jobs and stem the tide of unemployment nationwide.

The rollout of the program hit many bumps along the way, and the original funding allotment rapidly ran dry. Now, Congress has passed another $310 billion round of funding late on Thursday, April 24 (TechCrunch). We don’t yet know when the Small Business Association will reopen applications. But given how quickly the original funding dried up, if you want to access this resource to support your business, you will be ready to apply as soon as the loan application itself opens.

Let’s dive into what information we have right now so that you can be ready to get the ball rolling for your business if and when the time comes.

Please note: We are not legal experts. If you have specific questions about your business or loan application, please speak with your attorney and/or bank for clarification.

What is the Paycheck Protection Program?

The Paycheck Protection Program is a Small Business Association (SBA) loan program specifically designed to help small businesses continue to make payroll at their staff’s current pay rate, as well as cover key expenses that keep the lights on (think rent and utilities). Any loan funds used for these express purposes during the loan’s eight-week period will be eligible to be forgiven: in other words, if a small business uses the loan as it’s intended, they will likely not have to pay back a penny.

By driving cash into threatened small businesses, the Paycheck Protection Program directly addresses what 70% of small businesses cite as their primary business challenge: cash flow management (Forbes). About half of small businesses don’t have enough cash on-hand to survive more than 27 days without incoming revenue, and about 25% can only make it 13 days or less with no revenue (JP Morgan). With a PPP loan to cover about two months’ worth of most costly expenses (payroll and rent), small businesses will be able to stretch out their existing cash reserves much longer. Hopefully long enough for this crisis to end and for businesses to re-open.

In the meantime, with this loan, small businesses should be able to hold onto their existing team, preserve their retail or office space, and maintain their current utilities providers. This can provide small business owners and employees the opportunity to collaborate to find a way to pivot the business to find alternate revenue sources during COVID-19; and once the crisis ends, small business will still have their fully-trained team on-hand to ramp back up to their usual business model and capacity.

If laying off all your employees is like taking the wheels off a bike so it can no longer run, think of the PPP as enabling small businesses to put on training wheels. You can keep going, though perhaps not as quickly. If you hit a bump, you might not fall totally over. But the most important thing is that you keep moving.

Questions about the PPP? Join Elaine for a live Q&A!

How can the Paycheck Protection Program help your small business?

Now that we’ve covered the goals and potential impact of this program, let’s take a closer look at the details. I’ll answer common questions that small business owners likely have about the PPP, including how to determine if you’re eligible, how to apply, how the PPP compares to SBA’s EIDL loans, and more.

How do I know if I’m eligible?

You should be eligible to apply if:

- You’re a small business, 501(c)(3) nonprofit, or a 501(c)(19) Veterans Organization based in the United States.

- You have fewer than 500 employees.

- You’re self-employed or a sole priorietor.

- Your business has been adversely impacted by COVID-19, and the current uncertainty makes it difficult to run your business.

- You need this loan to keep your business afloat.

- Your business was fully operational on February 15, 2020, with employees on payroll.

How much can I borrow through PPP?

- If you’re a small business: You can receive a loan for up to 2.5x your average monthly payroll costs for the previous 12 months (up to $10 million total). Note: A small business cannot claim any independent contractors’ usual pay in their “payroll costs,” as independent contractors are eligible to apply for their own loan (SBA) (updated 4/3).

- If you’re a sole proprietor or are self-employed (e.g., you run your own one-person marketing agency): Although you don’t have payroll costs in the same way, the loan amount you’re eligible for is still calculated based on your payroll costs for the past 12 months; you full loan amount may be up to $100,000 (the maximum amount small businesses are allowed to claim as payroll costs per employee). See the “What counts as payroll costs” section of this US Treasury resource for more details. Note: This information is up to date as of 4/1/20. We will update this section as more details for sole proprietors and self-employed individuals are clarified. If you have questions, we recommend speaking to an attorney.

What is the loan period?

The loan period lasts for eight weeks from the date of origination (the date the borrower officially receives the loan). Interest payments will be deferred for six months. The loan will be due in 2 years, and there’s no penalty for pre-paying (US Treasury).

Updated 6/10: The loan period has been extended for up to twenty-four weeks.

What can I use the loan money for?

The loan is designed to help keep businesses running and people employed. Based on the latest guidance from the SBA, you should plan to use at least 75% of the loan monies to pay your staff’s salaries during the eight-week loan period, if you plan to apply for loan forgiveness. If you’ve had to lay people off, their pay will not be included in the calculation of the loan amount. But if you hire them back after submitting your application, we believe you can use your loan monies to pay them. If you lay off additional employees after applying for the loan, or if you decrease your employees’ pay, the amount you will be eligible to have forgiven will be impacted.

The remainder of the loan amount (up to 25%) can be used on:

- Rent

- Interest on their mortgage principle

- Utility payments

If you stick to the above expenses (75% for payroll, no more than 25% for rent, mortgage interest, or utilities), you should be able to have 100% of their loan forgiven (updated 4/3). Learn more details from the SBA here.

Updated 6/10: The requirement that borrower’s use 75% of funds on payroll costs has been changed to 60%. You can find more information on this update here.

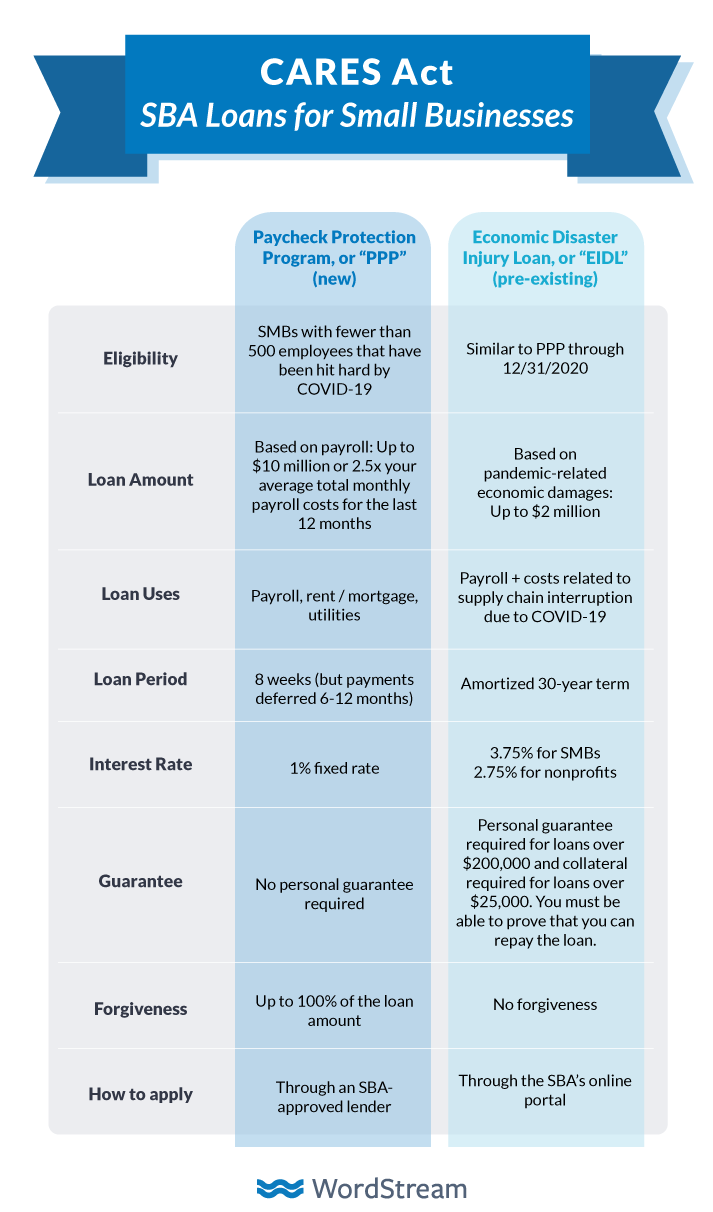

Is this different from the SBA’s Economic Disaster Injury Loan (EIDL)?

The PPP builds on the existing framework of the SBA’s 7(a) loan program for small businesses. The Paycheck Protection Program loans will co-exist with the SBA’s Economic Disaster Injury Loans, so you’ll want to evaluate both programs to select which option, if either, is better suited for your business.

If you’ve already taken out an EIDL due to COVID-19 related challenges, you may be able to refinance your existing loan as a PPP loan (Foley).

How can I apply?

You will need to gather the required documentation, complete your PPP loan application (download the final application form here), and apply via an SBA-approved institution (find one here), ideally your business’ existing bank. See more info from the US Treasury and the SBA (updated 4/3).

When can I apply for a Paycheck Protection Plan loan?

Updated 4/24: We don’t know when applications will re-open, once the new round of funding is signed into law, but the money will definitely go quickly. Potential applicants will want to contact their bank right away to begin this process if they haven’t yet. See this the US Treasury for more details.

Updated 6/10: The final day that Paycheck Protection Program loans will be approved is June 30.

When will I get my Paycheck Protection Plan loan amount, if my application is approved?

Updated 4/24: We don’t know yet. We’ll update this as we find more information. Based on the first round of funding, the time it takes to receive funds may vary—some businesses in the first round received their loan monies quickly, while others experienced delays.

Where can I get more information?

You can find the full text of the CARES Act here. Here are more resources:

- “Paycheck Protection Program (PPP),” the SBA’s official webpage on the program.

- “Paycheck Protection Program (PPP) Information Sheet: Borrowers” from the US Treasury Department.

- “Coronavirus Response Toolkit” from the US Chamber of Commerce.

- “Coronavirus Aid, Relief, and Economic Security Act: What Small Businesses Need to Know” from the US Chamber of Commerce.

- “What’s Inside The Senate’s $2 Trillion Coronavirus Aid Package” from NPR, outlining all the CARES Act provisions for SMBs.

- “Getting Cash for Your Small Business through the CARES Act” on Forbes.

- “SBA Loans Under the CARES Act” from law firm Foley & Lardner, describing the differences between PPP and other SBA loans.

- “How Paycheck Protection Loans Are Different Than Traditional 7(a) SBA Loans” from Inc.

- “Coronavirus Emergency Loans Small Business Guide and Checklist,” from the US Chamber of Commerce.

- “How to Submit Your SBA PPP Loan Application and Calculate the Loan Amount,” a helpful article from Entrepreneur.com

- “3 Steps (and a Calculator) to Help Determine Forgiveness for Your PPP Loan,” Nutter McClennen & Fish LLP.

What if I have more questions?

More details about this program are being released by the minute, so we may not have answered all your questions! We will be updating this article with updates as we see them, but please be sure to be on the lookout for relevant updates as well.

More resources for SMBs and online advertising during COVID-19

- How the Coronavirus (COVID-19) Pandemic is Affecting Small Businesses & Marketers

- 6 Strategies for Facebook and Instagram Advertising During the COVID-19 Pandemic

- Marketing During COVID-19: 4 Essential Copywriting Guidelines

- Navigating COVID-19: A Simplified Guide to Resources for SMBs

- How COVID-19 has Impacted Google Ads Results for 21 Industries [Data]

- 4 Major Trends Caused by COVID-19 and How to Respond [Data]

- Updated Google Ads Benchmarks for Your Industry During COVID-19 [Data]

- How COVID-19 Is Shaping Google Search Trends & Patterns [Data]

Meet The Author

Elaine Stone

As a product marketer here at WordStream, Elaine helps launch new products that empower small businesses to grow. Outside of the office, she might be found exploring the great outdoors, taking dance classes with her husband, or tracking down the best live jazz in Boston.

See other posts by Elaine Stone

More Articles Like This

Comments

Please read our Comment Policy before commenting.